William M. Sparks 1945 - 2023

William M. Sparks 1945 - 2023

My father, William (Bill) Sparks, passed away sadly but comfortably Sunday morning, surrounded by his family. He was a kind and loving man with a heart of gold. There are so many who loved him and will feel this loss – in the business world and far beyond. He would say thank you to all of his small-business customer for their support, and he would wish everyone peace and happiness. I have run the William M. Sparks Insurance Agency for many years now, and I will continue to run it just as my father did and as he would want me to do. On behalf of my family, I thank you all for your kind words, well wishes and support at this time. --- Danielle Sparks

According to the Washington Post, "Car theft continues to plummet" -- dropping by almost half from 2005 to 2011 in Maryland, Washington and Virginia. This seems to be due to improved automobile technology and the fact that police now have better tools to combat vehicle theft.

According to the Washington Post, "Car theft continues to plummet" -- dropping by almost half from 2005 to 2011 in Maryland, Washington and Virginia. This seems to be due to improved automobile technology and the fact that police now have better tools to combat vehicle theft.

Even so, auto theft is still a significant problem.

A recent AAA motor club report, compiling federal and insurance industry statistics, shows that about half of all stolen cars were unlocked and a vehicle theft still happens every 43 seconds in the U.S.

What vehicle makes and models are popular with car thieves?

It varies, state to state. In Washington, it's the Dodge Caravan. The Jeep Cherokee is the thief's choice in Virginia, while in Maryland it's the Honda Accord.

Are you wondering how you can better protect your car?

Take a look at these tips that we found on Anne Arundel Community College's website. They were directed at students on campus, but they are just as meaningful to all of us.

- Install a vehicle alarm or mechanical lock for steering wheel or ignition.

- Lock doors and leave windows rolled up.

- Always activate auto alarms or anti-theft devices.

- Keep valuables out of sight. Displaying valuable items in plain sight invites theft even if the vehicle is locked. Don’t advertise the types of equipment you have in your vehicle.

- Place valuable items in the trunk – not the front or back seats.

- Know the license number, year, make and model of your vehicle.

- Do not leave money, checkbooks or credit cards in the vehicle at any time.

Would your auto insurance cover auto theft?

If you have not done so recently, maybe it's time to check with your insurance agent to be sure that you have the appropriate insurance in place. Don't wait until the worst happens only to find that your coverage is incomplete.

Here at the William M. Sparks Insurance Agency in Lutherville - Timonium, Maryland (MD), our experienced agents welcome your inquiries. We can review your auto insurance policy and help you explore your coverage options if necessary. Feel free to contact us at your convenience.

Prom Season – High Excitement… High Risk

If you have teenagers in your home, then you know this is a special time of year. High school seniors are celebrating the end of their high school career, eager for graduation and looking forward to taking that next step into the world. For many high school teens, this is the much-anticipated Prom Season – a time when memories of a lifetime (good or bad) will be created for both teens and families.

Yet, the excitement at this milestone comes with significant risk. According to the National Highway Transportation Administration (NHTSA), prom and graduation season – April through June – is the time when most teen motor vehicle deaths and serious injuries occur. Moreover, NHTSA tells us that alcohol-related crashes kill more 16-20-year-olds than those of any other age group. Sadly,a report by Students Against Destructive Decisions (SADD) shows that most teens in this age group get their alcohol from family or friends.

VIDEO: Maryland Officials Warn Against Teens, Drunk Driving and Prom Night

VIDEO: Prom Season – Protecting Teens from Drunk Driving (III.org)

How can parents prevent this season of celebration from turning into tragedy?

The experts at the NHTSA and SADD, as well as many other organizations agree on the following critical steps parents should take to keep their teen drivers safe during Prom and Graduation season.

- Get a commitment from your teen that their cell phone will be on throughout the evening and designate times to have them check in with you as the evening progresses. Clearly emphasize that your teen can call you – no questions asked – .if they need a safe ride home and/or any problem occurs.

- Find out about your teen’s plans for the evening and determine who will be responsible for driving. Then confirm your child’s plans with other adults such as other trusted parents or school officials.

- Discuss your expectations and outline your rules, those of law enforcement and of the school for the evening.

Auto Insurance Tip

If your teen will be driving, you’ll want to be sure that they are well covered either by your auto insurance policy or their own. For your own peace of mind, confirm the coverage with your insurance agent.

Here at the William M. Sparks Insurance Agency in Timonium, MD, we wish your family the best for graduation and prom season; and our staff is available to answer discuss your insurance coverage at your convenience.

There Could be Danger Lurking in Your Laundry Room

Most of us never think very much about the condition of our washer and dryer until something goes wrong. We believe they will always be dependable… and safe. Have you ever stopped to consider that your clothes dryer might be a serious fire hazard? The U. S. Fire Administration (USFA) (a division of FEMA) reports that close to 100 injuries, five deaths and about $35 million in property loss result from an estimated 2,900 clothes dryer fires occurring in homes each year.

The USFA’s report also tells us that clothes dryer fires appear to happen more frequently in winter months. They have found that the main cause of such fires is the failure to thoroughly clear lint and fibers from the dryer, mostly because the lint that is not caught by the filter which settles around the exhaust pipe or the heating element where it can ignite.

Good News: You Can Prevent Dryer Fires

The National Fire Protection Association (NFPA) has made available their Clothes Dryer Safety Tip Sheet to make your dryer safer. Some of these very important tips are as follows.

- Always use a lint filter when operating the dryer.

- Do not leave the dryer operating when you go to bed or if you leave home.

- Rigid or flexible metal venting material should be used to sustain proper air flow and drying time.

- Test the outdoor vent flap to see that it opens when the dryer is operating, and be sure the air exhaust vent pipe is not restricted at any time.

- Follow the manufacturer’s operating instructions, and don’t overload your dryer.

Homeowners Insurance Tip

Home fires – no matter the reason – can be a devastating threat to life and property. Be sure your home is properly protected by your homeowners insurance. If you are not sure about your coverage, now is the time to arrange a meeting with your insurance agent for a policy review.

Contact our experienced agents here at the William M. Sparks Insurance Agency to review your home owners insurance policy to be sure you have complete coverage to meet your needs at the best rate available.

Car Shopping Now Quicker, Easier and Safer

It’s a brand new year. Is this the year when you’ll replace that old car? Perhaps you’re thinking about it, but dreading all the research you’d have to do to decide on a new model that meets your family’s needs.

Would it be easier if you could find out the safety rating of the makes and models you’re considering – right there in the car lot? Well now you can do just that using your smart phone? Think of the time you’ll save!

You might ask why check a car’s safety rating before buying. Not only is it important that your new vehicle offer you and your family the best protection in a crash, but the safety rating also influences your auto insurance bill.

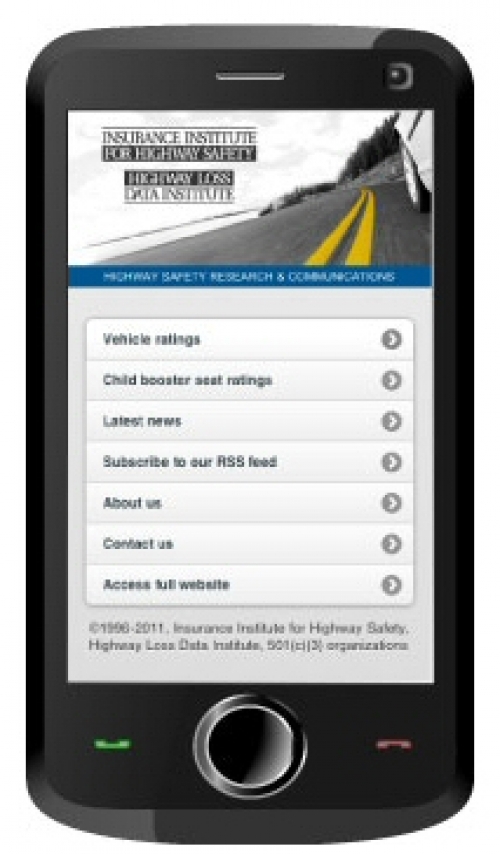

Now, the Insurance Institute for Highway Safety (IIHS), has made it easy for car shoppers to check on the auto safety ratings and crash test results while browsing on the dealer’s showroom floor or anywhere else. The Institute has launched a new mobile website so consumers can easily compare vehicle safety ratings.

In fact, the site does much more. You can also compare child booster seat ratings, the latest highway safety news and much more. You can also use your smart phone to sign up for an automatic RSS feed when new material is available.

The IIHS routinely publishes the results of tests showing the performance of a given car, truck, SUV or van in protecting passengers in front, rear and side impact crashes as well as in rollovers. Depending upon how they perform, each vehicle is rated as good, acceptable, marginal or poor. Vehicles that perform to the highest standards receive the distinction of TOP SAFETY PICK.

Auto Insurance Tip

If you’re in the market for a new or used car, don’t forget to get your insurance agent’s input in advance. In fact, our experienced agents, here at the William M. Sparks Insurance Agency in Timonium, MD, are ready to help you with all your insurance questions. Just contact us at your convenience.

Identity Theft Myth #1: Shredding my mail and other documents will protect me from identity theft

We all know at least one person who uses their home shredder to diligently destroy all to-be-discarded documents and postal mail and removes all labels bearing their name, address, phone or any other personal information. Perhaps you do it yourself. The good news: shredding documents that contain personal information before you throw them away is a very good habit to have. It is the best way to disappoint any "dumpster diving" thieves who might search your garbage to find your personal information.

But if that is all that you do, then you are leaving yourself open to identity theft in many other ways. Do you store your auto registration, insurance cards and/or auto repair receipts in your car? Do you ever leave bills, checkbooks and documents lying on the kitchen counter or desk where they may be viewed by visitors or service technicians in your home? Do you store personal identification and other details on your computer without password protection? Do you provide personal information when contacted by phone or e-mail as long as you recognize the company on your caller ID or computer? Do you keep a cheat sheet of computer passwords on your desk at work? Avoiding identity theft and related fraudulent crimes means that you must think defensively at all times. This means securing your personal information in your car, your office and your home; and always practice safe online security habits.

Deterring Identity Theft

Unfortunately, there is no guarantee that you will never become a victim of identity theft. Learn more about Identity Theft and how to minimize your risk.

Avoiding Identity Crime Online

Read about the common-sense ways to assure computer security and protect yourself from identity theft and related fraud without minimizing your ability to use today's technology.

But What if Identity Theft Happens?

The bad news is that you might not even know if you are a victim of identity theft for a very long time. In fact, until you find that accounts are open in your name that you did not create or you receive notice of tax or legal violations or perhaps your bank account is emptied. When you realize what has happened, then you must begin the long, frustration and often expensive process of restoring your reputation and recovering your identity.

Identity Recovery Insurance

The good news is that you can take measures to protect yourself through Identity Recovery Insurance which will offer guidance, assistance and most importantly financial benefits to help you move forward.

Many of the major insurance carriers today offer this coverage, and the method differs. Some offer a stand-alone policy while some offer coverage as a part of a homeowners insurance pollicy. Still others offer it as an endorsement.

So, how do you get this coverage?

You should start by asking your insurance agent. In fact, here at the William M. Sparks Insurance Agency in Timonium, MD, our experienced agents can give you all the details and help you make the choices needed to assure that you have a place to start and a helping hand to recover from identity theft. Why not contact us to find out what your options might be -- now... before you ever need it.

Tag Cloud

|

|

|