William M. Sparks 1945 - 2023

William M. Sparks 1945 - 2023

My father, William (Bill) Sparks, passed away sadly but comfortably Sunday morning, surrounded by his family. He was a kind and loving man with a heart of gold. There are so many who loved him and will feel this loss – in the business world and far beyond. He would say thank you to all of his small-business customer for their support, and he would wish everyone peace and happiness. I have run the William M. Sparks Insurance Agency for many years now, and I will continue to run it just as my father did and as he would want me to do. On behalf of my family, I thank you all for your kind words, well wishes and support at this time. --- Danielle Sparks

If you have a teenager headed to college this year, toting a computer and cell phone as well as all the other valuable digital items, have you considered what happens if these items were to be vandalized, stolen, damaged or destroyed? Would your homeowners policy provide the coverage to replace your student's possessions while away at college?

With all the other worries when your kids are going to college, this is one you don't need to suffer. It's possible to protect your kids' valuables with insurance.And, if you do your homework and check out your options, you can avoid the risks of being caught unaware about your homeowners insurance coverage.

We recommend sitting down with your child to list all items that will be moved to campus so that you can put a value on each item.

Next, contact your insurance agent and verify the extent of coverage and limitations on your current homeowners insurance policy. Once you know the maximum coverage limit provided by your homeowners insurance for your student, it's a simple matter to compare it to the total value of your child's belongings. If, the maximum amount of allowable coverage falls short of the total value of the items, you’ll be able to increase your coverage before there is a need to file a claim.

Your insurance agent will need to know whether your child will be living on campus or in an off-campus dewlling. Most homeowners insurance policies will cover your student's personal property in a dorm up to the limits of your policy but not if he/she will be living off-campus. Instead, you will need to consider renters insurance.

Regardless of the type of insurance needed, you'll want to create an inventory ahead of time of all items – with serial numbers, descriptions, and other details – andlet your teen know about taking normal precautions to protect their belongings.

Be prepared, learn about your insurance coverage before sending your child off to campus, and it will mean a smoother transition for both of you. The key: Don't just assume that your kids' possessions at schoolare fully insured. Instead, check with your agent to understand all insurance options.

Here at the William M. Sparks Insurance Agency, we often help parents as they sort through their options when the time for college is close. We can assist you and answer your questions. Why not contact us at your convenience for a no-obligation review of your homeowners insurance policy and a discussion of what might be your best course of action.

Keeping your deck safe and ready for summer fun can be a challenge for homeowners like yourself. In this issue of the Homeowners Maintenance Series, offer the following tips to enjoy outdoor entertaining on your deck and still avoid insurance claims .

Keeping your deck safe and ready for summer fun can be a challenge for homeowners like yourself. In this issue of the Homeowners Maintenance Series, offer the following tips to enjoy outdoor entertaining on your deck and still avoid insurance claims .

First, examine your deck for loose stairs and/or deck railings and for any warped or excessively work boards. Be sure to replace or repair them if/as needed.

If the decking surface shows staining where the deck joins the house, it likely indicates water leakage; so you'll need to check further for wood decay which can weaken the deck’s structural integrity. If you suspect that the structure is compromised, then consider contacting a decking professionalfor a professional opinion and advice or repair as needed.

Moss and mold will cause your deck's surface to become slippery – a hazard for your family and other visitors. But you can easily remove this growth through pressure washing the surface. If you do your own pressure washing instead of hiring a pro to do the job, then take the time to fully understand how to use the equipment properly and safely before you begin.

If resealing your deck is necessary -- either because of general wear or because power washing has to be done, then be sure to investigate and purchase the best product for the job and avoid shotcuts that could compromise the result. Otherwise, you will find yourself re-doing the job within a year.

Examine and test your deck lighting and any wiring for signs of wear or malfunction. Replace bulbs or light fixtures as needed; but, if you have sophisticated outdoor wiring and/or lighting that shows malfunction, then consider having a licensed electrician do a check-up.

part of maintaining the value of your home is caring for your deck. But,perhaps more importantly, by maintaining your deck properly you’ll be protecting yourself from injury claims against your homeowners insurance policy.

Here at the William M. Sparks Insurance Agency in Timonium, MD, we recommend that you to check with your insurance agent for a review of your homeowners policy if you have not done so recently. This allows that you will have adequate liability coverage as you use your deck for recreation and entertaining this summer.

Find out more about Homeowners Insurance.

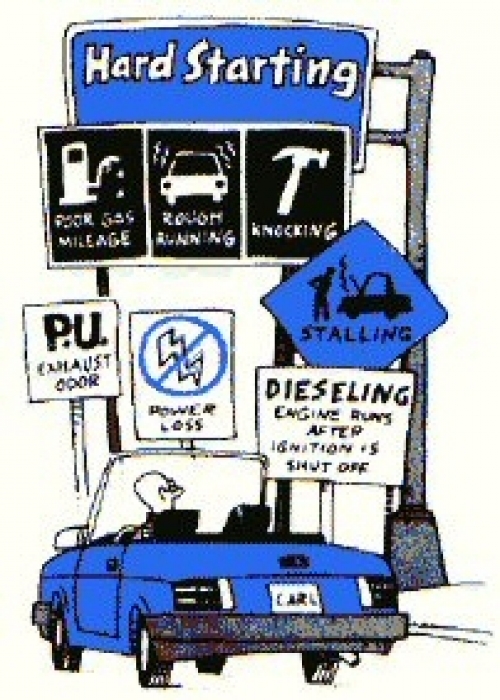

Is your family like the many others who eagerly anticipate summer road trips? If you have done a summer road trip in the past, then you know that you can't just hop in the car and go. Before you drive off to enjoy the open road, it's important to be prepared for your trip. Take the time to check the vehicle you'll be driving and to pack properly; but remember to review your auto insurance policy. Following these few guidelines should make your road trip the kind of memorable adventure that you and your passengers hope for.

Have your car checked by your mechanic...

The National Highway Traffic Safety Administration (NHTSA) has published some great advice for planning a safe and stress-free summer road trip. Of course, it includes doing a complete inspection of the vehicle you'll be driving. They caution not to wait until the last minute. They recommend that you check the following systems on your car, truck, SUV or van well in advance of your road trip. Some or all of these checks should be done by a trusted mechanic.

- Cooling System —coolant level and need for service

- Fluid Levels — engine oil, windshield, transmission, brake, and power steering fluids

- Hoses and Belts —fittings and signs of wear

- Air Conditioning System – components and cooling function

- Lights — interior lights, turn signals, emergency flashers, headlights, brake lights and trailer lights, if any

- Tires – air pressure and wear on the tread for all tires including spare tire

- Wiper Blades – wear and tear on both passenger’s and driver’s sides

Check your insurance with your agent...

Will you be doing all the driving or sharing the driving with someone else? Will you be driving your own vehicle, someone else's or a rental car? Your auto insurance agent can help you assure that you will have proper coverage, no matter what your arrangements. Don't wait until after an accident occurs only to find that your insurance will not cover your claim.

Will you rent a car for your road trip?

Although the car rental company can provide insurance coverage, your current auto insurance policy might cover your rental vehicle. Moreover, your credit card company might also offer some reimbursement, should there be an accident. Well before the time for your trip, take the time to ensure that you will be fully covered but without duplication by finding out what coverages the rental company offers and what options the credit card company offers and then by calling your insurance agent for advice. To learn more, see what the Insurance Information Institute (III) advises regarding car rentals and insurance.

Be prepared, in advance, for roadside emergencies...

Seasoned travelers recommend packing a Roadside Emergency Kit to help, should you be stranded during your road trip. The National Highway Traffic Safety Administration (NHTSA) suggests that your kit should include fresh drinking water, non-perishable food, a flashlight,basic repair tools, jumper cables, flares and white flag as well as work gloves. Of course, you will want to take along a cell phone and have a charger in the vehicle. Even though GPS devices are popular navigational tools, it's still wise to take along a map of your travel route as a back-up reference.

Plans Complete? Enjoy your trip...

Whether you plan all stops in advance or pick your route and make your plans on the fly as you go, the time you devote to preparing before taking to the road will e time very well spent.

From this issue of our Homeowners Maintenance Series come the following tips to help maintain your garage door in good working order. A few quick checks could prevent insurance claims while ensuring safety for your family.

From this issue of our Homeowners Maintenance Series come the following tips to help maintain your garage door in good working order. A few quick checks could prevent insurance claims while ensuring safety for your family.

Examine your automatic garage door opener to be sure that it both opens and closes the door as it should.

The manual function of your garage door is just as important as the automatic door opener. Take a moment to see that the door is balanced and lifts easily and smoothly. The door remains open on its own to about 36 inches off the ground. If it does not, then servicing by a trained technician should be done; and be sure they check the overhead spring.

Proper manual operation is important in the event of a power outage or if your automatic garage door opener is lost. In fact, FEMA recommends that you locate your garage door’s manual release lever well before a power failure ever makes it necessary, and be sure to let your family know how to operate it as well.

An important garage door safety check...

For safety purposes, the reversing force of the garage door must be set properly.This is the function that prevents the tragic consequences of the garage door closing - and remaining closed - on a small child or a pet.

Here's how to check that function: Place a 2" thick block of wood in the location on the ground where the door comes down. Then, close the door. If it working properly, it will pop back up immediately upon hitting the wood block. If it does not, be sure to have the door checked by a professional.

Here at the William M. Sparks Insurance Agency in Timonium, MD, we urge you to check the function of your garage door regularly to prevent injuries to children, pets and others as they leave or enter your garage.This would also be a good time to check your insurance liability by having your insurance agent review your homeowners policy for adequate coverage levels if you have not done so recently.

In this issue of our Automotive Maintenance Series, we will provide tips for maintaining your car's air conditioning system. A few quick checks before your next long drive can assure safety and might also prevent insurance claims.

If you will be relying on your car during an upcoming road trip, it's advisable to have your car’s air conditioning system checked out by your local auto tech, even if has been cooling properly, so far. That way, you won’t find yourself stranded on the road during the dog days of summer with nothing but hot air belching from the vents.

Certainly, if your air conditioning system is not cooling as it should, that appointment with your auto technician should include check to see that the electric cooling fan motor near the condenser is working properly. A lack of air flow across the condenser could be the problem.

While you're at it, you might want to have your mechanic check the FREON® level and pressure. Gone is the time when you’d just stop by your auto repair and service shop to have the air conditioning system recharged with refrigerant when it was not cooling sufficiently. Now, it is considered more serious if your system has a refrigerant leak.

Why have attitudes about refrigerant loss changed so drastically? It has to do with the fact that scientists now know that FREON®, a chlorinated fluorocarbon (CFC) contributes to the depletion of the earth's ozone layer. As a result, auto manufacturers now use much improved materials in the lines, seals and hoses of their air conditioning systems to resist refrigerant leakage. Also, the newer Federal and state regulations now require that repair shops have the correct equipment and training for handling refrigerants.

If you are wondering if properly maintaining your vehicle might impact your auto insurance, then it is time to check with your insurance agent for the details. Here at the the William M. Sparks Insurance Agency, in Timonium, MD, we are available to answer your auto insurance questions and/or to assist you with a no-obligation car insurance policy review upon your request.

Tag Cloud

|

|

|